When a disaster hits, your building may require a complete remodel or have specific needs unique to your business. Whether you are looking for tips for filing insurance claims for water damage or advice on getting your insurance company to reimburse you for destroyed personal items, you’ll want to review the role a property manager can take.

While a sudden disaster may be a time of stress and panic, it is essential to understand and complete a few necessary steps before you call your insurance provider.

The safety and well-being of everyone in the building is always the top priority when a disaster strikes. You should have a response plan for different types of disasters:

Whatever the case, it is time to call the fire department or the police station after you have responded to the emergency at hand. First responders can ensure that everyone in the building is safe and present while dealing with the damage.

In some special cases, you may be able to make some decisions yourself. For example, if a burst pipe in the facility has caused flooding, you can locate the water source or turn off the water to the building to prevent further damage. However, most of the time, the police or first responders can assess the situation while keeping you out of harm’s way.

After the flood is dealt with or the fire put out, it is time to assess the damage for yourself to see what you’ll need to replace. Any observations of what happened during the disaster will help you communicate to your insurance provider and support your claim.

Ask yourself how the disaster affected the facility and how much of the building is exposed to the elements. Where is the most damage? You can also start collecting the necessary equipment to take photographs. Visual documentation will help you when it is time to show evidence of damage and receive your claim money.

It may be tempting to start cleaning after the police or fire department has left the scene. However, doing so can hurt your insurance claim. The insurance company will want to see the damage for themselves and will often need detailed proof that the disaster occurred. If you start to clean up pools of water or tear out areas that have experienced fire damage, your insurance claim may be lower than what you need to repair the building.

Once you’ve made it through to the other side of the disaster, it’s time to start taking the next steps in the recovery process.

After the disaster, you’ll want to decide if you want to contact your insurance provider or a local commercial and industrial property restoration company first:

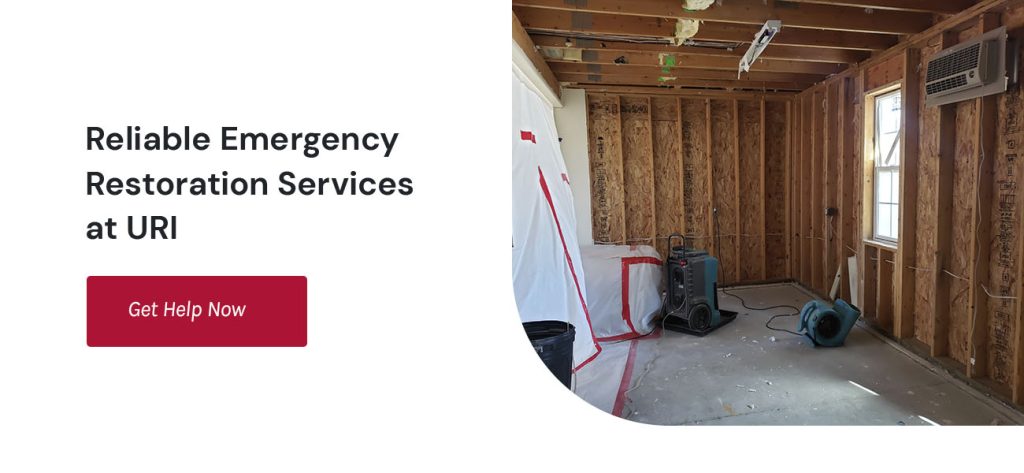

The restoration company should be able to provide you with consistent support while rebuilding your facility. A company with certified staff and a reliable reputation will be able to restore your building to its original state and implement your vision.

One of the most important things you can do after the disaster is to document all evidence of damage and lost belongs. Make a list of lost or damaged items, including their estimated value. A spreadsheet may be a great way to keep track of these items.

Consider making a walkthrough video of the building to show each room in the facility and the amount of damage they contain. You can also take pictures and upload them to a cloud server that you can access from anywhere.

Disaster cleanup involves restoring and repairing your building while safely handling the damage. A commercial and industrial property restoration company will often help you get the most insurance money you can to assist you in rebuilding, but keep in mind that you might not be able to return everything to its original state.

Some insurance companies may not offer you the total value of lost items, so you may be required to contribute your own money towards the process. However, this doesn’t have to be a negative experience. Consider taking this time to upgrade your building and add previously unavailable improvements. It may be a great time to spend a little more to remake the facility into a better place.

When filing a claim, it is crucial to understand your insurance policy. If you are wondering how to get your insurance to pay for water damage or items lost in a fire, you will need to be familiar with the actions you should take when working with your insurance company:

Filing a claim can be a complicated process that starts before you submit your evidence and continues after you’ve finished filing. Here are a few essential things to keep in mind throughout.

Before starting the insurance claims process for property damage, you must understand the nuances of your insurance policy and the documents you’ll need to send. Your reimbursement will depend on several factors, including the evidence gathered and the value of the items lost or destroyed. Reread your policy and consult with your advisor to ensure you understand how much of the damage your policy may cover.

Try to be helpful by providing as much information about the disaster as possible throughout the process. Your insurance adjuster will work to investigate your claim and decide how much money your claim will pay out to cover the damage to the property. They may interview you or visit your facility and inspect the building for the source of the damage. They may also ask for police reports or other documents, so be prepared with any files you think they might need.

After you have filed the claim, you’ll receive the amount the company is willing to provide. Negotiating the claim may be a good idea if you believe you require more money. In this case, you’ll want a team that advocates for you to get the money you need to fix the building.

While your insurance adjuster will recommend a specific amount, a commercial and industrial property restoration team can work with you to negotiate that number and raise the estimate. Remember that the insurance adjuster works directly for the insurance company and may try to lower your estimate.

After you’ve negotiated your claim and settled on a satisfactory amount, the insurance company will send a check. Afterward, you can start repairing the building.

You may obtain your check in various ways, depending on your situation. For example, if you’ve filed the claim on behalf of the building’s owner, your insurance company may send a check directly to them. Some insurance companies may pay the restoration service directly before mailing a check for the remainder of your claim.

Having your claim denied can be a stressful process. However, there are several steps you can take to try and arrive at a settlement. Here are a few things to do if your claim is denied:

It can be tricky to understand how to react to the restoration claims process. There are a few do’s and don’ts that may be good to review before diving into filing a claim:

You may want to familiarize yourself with some standard insurance terms during the claims process. Here are a few to keep in mind:

Unlimited Restoration was founded in 1996 and is dedicated to offering reliable disaster and damage mitigation services to the Northeast, Mid-Atlantic and Southeast areas. Our emergency response teams reply quickly to your request and do their best to restore your building. We work with a wide range of companies and businesses with industrial, commercial and institutional properties and our highly mobile efforts help to make the restoration process smooth and easy. Contact us today to learn more about URI or call our emergency response hotline for immediate assistance.